All Categories

Featured

Table of Contents

After buying a tax lien, you must alert the homeowners. This step is crucial and need to be done following legal needs. You'll either collect the tax obligation financial debt plus rate of interest from the home owner or, in many cases, you may finish up getting the building if the debt stays unsettled. While comparable, tax liens and tax obligation acts have a various sale public auction procedure.

When an individual bids and wins at a tax obligation action auction, the tax obligation act is moved to the winning prospective buyer, and they receive ownership and rate of interest of the residential or commercial property. If the state has a redemption period, the homeowner can pay the overdue taxes on the home and retrieve their possession.

Tax lien sales happen within 36 states, and 31 states allow tax action sales (some enable both). The particular buying process of these sales vary by area, so make certain to investigate the regulations of the area you are looking to purchase in before getting going. Tax obligation lien spending deals an one-of-a-kind chance for possibly high returns and home procurement.

Tax obligation lien investing can give your portfolio direct exposure to real estate all without needing to in fact possess building. Professionals, nonetheless, claim the process is made complex and warn that amateur capitalists can easily obtain shed. Here's everything you need to find out about buying a tax obligation lien certificate, including exactly how it functions and the risks entailed.

The notification normally comes before harsher activities, such as a tax obligation levy, where the Internal Earnings Service (IRS) or local or community federal governments can really confiscate a person's home to recover the financial debt. A tax lien certificate is created when a homeowner has actually stopped working to pay their tax obligations and the city government problems a tax obligation lien.

Profit By Investing In Real Estate Tax Liens Pdf

Tax obligation lien certificates are generally auctioned off to investors seeking to profit. To recover the delinquent tax bucks, towns can after that sell the tax obligation lien certification to exclusive financiers, that deal with the tax obligation bill for the right to collect that cash, plus passion, from the homeowner when they ultimately pay back their balance.

permit for the transfer or job of delinquent property tax liens to the private sector, according to the National Tax Obligation Lien Association, a not-for-profit that stands for federal governments, institutional tax obligation lien investors and servicers. Below's what the process appears like. Tax obligation lien financiers need to bid for the certification in an auction, and just how that procedure functions depends on the particular district.

Contact tax obligation authorities in your location to ask exactly how those delinquent tax obligations are collected. The community develops a maximum price, and the prospective buyer offering the least expensive rate of interest price under that maximum wins the public auction.

Various other winning proposals go to those that pay the highest possible money amount, or premium, over the lien quantity. The winning prospective buyer has to pay the entire tax expense, consisting of the delinquent financial debt, interest and charges.

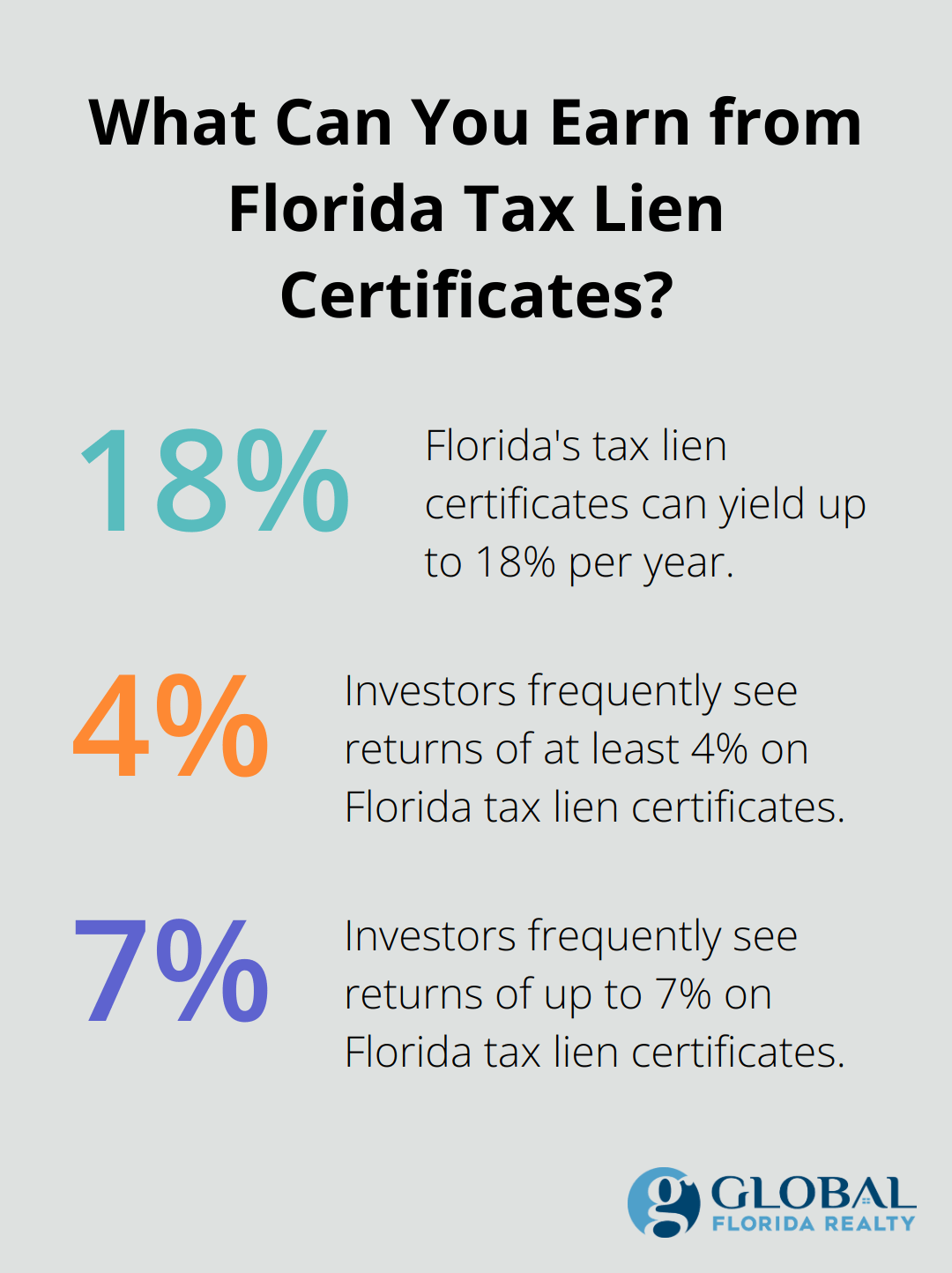

While some financiers can be rewarded, others might be caught in the crossfire of difficult guidelines and technicalities, which in the most awful of situations can lead to hefty losses. From a plain revenue point ofview, many investors make their cash based on the tax obligation lien's rates of interest. Rate of interest vary and rely on the territory or the state.

Profits, nevertheless, don't constantly amount to yields that high during the bidding procedure. In the long run, many tax obligation liens purchased at public auction are offered at rates in between 3 percent and 7 percent nationally, according to Brad Westover, executive supervisor of the National Tax Obligation Lien Organization. Before retiring, Richard Rampell, previously the president of Rampell & Rampell, a bookkeeping company in Palm Beach, Florida, experienced this direct.

Tax Lien Investing Pros And Cons

At first, the companions succeeded. But then large institutional capitalists, including financial institutions, hedge funds and pension plan funds, chased those higher yields in auctions around the nation. The larger capitalists aided bid down interest prices, so Rampell's group had not been making significant cash anymore on liens. "At the end, we weren't doing far better than a CD," he states.

But that hardly ever takes place: The tax obligations are typically paid before the redemption day. Liens additionally are initial in line for payment, even prior to mortgages. However, tax liens have an expiry date, and a lienholder's right to confiscate on the residential property or to accumulate their investment expires at the very same time as the lien.

Investing In Tax Liens In Texas

Individual capitalists who are thinking about investments in tax obligation liens should, above all, do their research. Experts recommend preventing residential properties with ecological damage, such as one where a gas terminal discarded unsafe material.

"You should truly recognize what you're purchasing," says Richard Zimmerman, a partner at Berdon LLP, a bookkeeping company in New York City. "Know what the building is, the neighborhood and worths, so you do not buy a lien that you won't have the ability to accumulate (tax lien investing online)." Prospective investors must also have a look at the property and all liens against it, as well as recent tax obligation sales and price of similar residential or commercial properties

Maintain in mind that the information you find can commonly be obsoleted. "People obtain a listing of buildings and do their due persistance weeks before a sale," Musa states. "Fifty percent the residential properties on the listing may be gone due to the fact that the tax obligations get paid. You're losing your time. The closer to the date you do your due diligence, the much better.

Westover claims 80 percent of tax obligation lien certificates are offered to participants of the NTLA, and the agency can commonly pair up NTLA members with the right institutional financiers. That could make managing the process simpler, particularly for a novice. While tax lien investments can supply a generous return, be mindful of the great print, details and guidelines.

"Yet it's complicated. You need to understand the information." Bankrate's added to an upgrade of this story.

The secret to is to enable your money to help you. Tax liens are a reliable method to do this. In Arizona, a person may get tax obligation liens and get up to 16% on their financial investment if they are retrieved. If they are not retrieved, the capitalist might confiscate upon the home after three (and as much as ten years). The procedure is relatively simple.

Tax Lien Investing Risks

The. The capitalists bid on tax obligation liens at a reverse public auction, implying that at 16% there might be 10 people interested in this tax obligation lien, however at 10% there might be three people, and you might be the winning proposal if you're still interested in the tax obligation lien at 5%.

If the tax obligation lien is not retrieved, you have a right to bid on subsequent tax liens. If you hold the tax lien between three and 10 years, you might begin the process of confiscating upon the tax lien. To seize upon a tax obligation lien in Arizona, the certificate of acquisition holder should first send a certified letter thirty days before submitting a claim to offer notice to the lienholder that pleases the appropriate statute.

The real estate tax obligation parcel recognition number. The legal summary of the real residential property. The certification of acquisition number. The proposed date of submitting the action. For the most part, the building owner will redeem the taxes before you have to foreclose. When the lien holder redeems, the owner of the certification of purchase gets its principal plus its passion.

If you are interested in the tax lien foreclosure process, you must get in touch with an attorney so you recognize and evaluate the dangers of this kind of financial investment.

Tax Lien Investing Expert

The yearly public auction of real estate tax obligation liens will certainly be held as a net auction. Bidding process will begin on November 4, 2024, at 8:00 a.m. local time and will certainly close on November 6, 2024, at 5:00 p.m.Delinquent Real Estate Tax payments must be received in our office by 3:30 p.m. local time Friday, November 1, Overdue.

Table of Contents

Latest Posts

Delinquent Tax Sale

How To Do Tax Lien Investing

Tax Lien Investing Expert

More

Latest Posts

Delinquent Tax Sale

How To Do Tax Lien Investing

Tax Lien Investing Expert